Let’s us discuss in this post a few confusing concepts in economics related to the currency market. We shall see in this article, the difference between Rupee Devaluation and Rupee Depreciation.

Let’s also trace the value of Indian rupee with respect to US dollar from 1947 and see how a fall in rupee value affects exports and imports.

Who fixes the value of Indian Rupee against US dollar?

Interesting question. Do you think the Indian government fixes the value of Indian Rupee against US dollar?

If not, who fixes it?

RBI?

No.

At present, none of these entities fixes the value of Indian Rupee. Now the value of Indian Rupee (or any other currency) is determined by the market.

Yes, Market!

Here market means the currency market.

The demand and supply forces in the currency market determine the price of each currency.

If the demand for Indian currency is high, Indian rupee will appreciate (for example 1$ = Rs.40), and if demand is low, it will depreciate (for example, 1$ = Rs.70).

If market forces determine the value of a currency, that type of system is called Floating Rate System. India has adopted the partial floating rate system since 1975, and from 1993 is fully dependent on Floating Rate System.

This means that our Prime Minister, Finance Minister or RBI chairperson cannot fix the currency exchange rate at the click of a button. But they still have some control – through policy measures or by controlling foreign exchange reserves.

Fixed Rate System vs Floating Rate System

If the government or RBI fix the exchange rate of a currency (and does not allow any variations according to demand and supply forces in the market), such a system is called the Fixed Rate system. It is also called the Bretton Woods system or Pegged Currency System.

India was following this kind of system till 1975 and partial controls followed until 1993. Since this currency valuation mechanism is artificial, most of the countries including India changed to Floating Rate System where currency market determines the value of a currency.

Rupee Devaluation vs Rupee Depreciation

The term devaluation is used when the government reduces the value of a currency under Fixed-Rate System. When the value of the currency falls under the Floating Rate System, it is called depreciation.

Revaluation is a term which is used when there is a rise in currency value in relation with a foreign currency in a fixed exchange rate. In the floating exchange rate regime, the correct term would be appreciation.

Note: Altering the face value of a currency without changing its foreign exchange rate is a redenomination, not a revaluation.

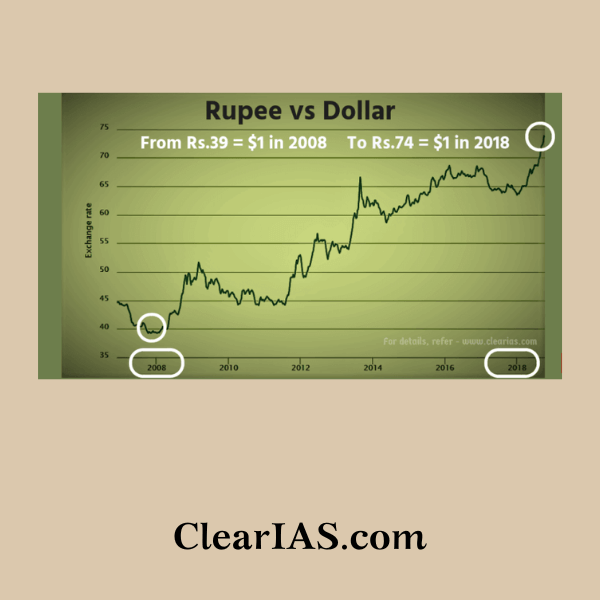

History of Indian Rupee: A comparison of Indian Rupee Value vs US dollar

- 1947: 1 US$ = 1.00 INR (Sounds interesting, huh? :-))

- 1948: 1 US$ = 4.79 INR.

- 1965: 1 US$ = 4.79 INR.

- 1966: 1 US$ = 7.57 INR.

- 1971: 1 US$ = 8.39 INR.

- 1985: 1 US$ = 12.0 INR.

- 1991: 1 US$ = 17.9 INR.

- 1993: 1 US$ = 31.7 INR.

- 2000: 1 US$ = 45.0 INR.

- 2013: 1 US$ = 60.0 INR.

- 2017: 1 US$ = 65.0 INR.

- 2018: 1 US$ = 74.0 INR.

The value of the Indian Rupee: Does it matter?

It should not be forgotten that the exchange rate of a currency is not really an indicator of the economic strength of a country.

There are many countries including China which favours the devaluation of the currency.

Also, the economic position of India in 2017 is far better than that of 1947, though there is a fall in Rupee value.

At present what should worry the Finance Minister and RBI governor should not the falling Indian Rupee, but the fluctuations in the currency market. What India needs is stabilization of Indian Rupee value, be in Rs. 50, Rs.60 or Rs.70 per 1 US dollar. But if rupee is Rs.60 one day and if it Rs. 65 the next day, it shows high volatility. Such a situation is not good for the economy and that will only trigger more fall in Indian rupee.

Depreciation and Appreciation of Indian Rupee: Relation with Exports and Imports

Answer: They do it mainly to improve the balance of trade (or in other words, to increase exports and decrease imports!).

Exports vs Fall in the Indian Rupee Value: The local currency effect

In other words: imports become more expensive; importers lose money while exporters earn more money.

This is supposed to discourage imports – and to encourage exports and, in turn, to reduce trade deficits.

Clear, uh?

Well, that was an explanation with respect to the local currency angle. Let’s see the same case analyzing the volume effect angle as well.

Exports vs Fall in the Indian Rupee Value: The volume effect

- Before rupee devaluation: Americans will get only 1 apple for 1 dollar.

- After rupee devaluation: Now Americans will get 2 apples for 1 dollar.

Think from the American perspective. For them earlier with 1$, they used to get only 1 apple. Now after falling in Indian rupee, they get 2 apples.

So importing from India has become really cheaper for America and they will use this case to their maximum advantage.

This case will favour exporters in India in two ways:

- (1) They can now sell more apples (volume effect), trade volume will increase.

- (2) Indian currency they get when converted is now higher than before. (It was Rs.50 before, now it is Rs.100 – for 1 US$ received)

Thus, every time there is a fall in rupee against US dollar, exporters from India are benefited. (Eg: Software companies, seafood exporters etc.)

This situation badly affects importers or those who wish to visit the US for holidays as they need more local currency to get the same service or product.

Hope the confusing topic is clear for you. Leave your feedback or queries in comments.

thanking you sir .gave this information .i have very weak in geography questions .so h ow to improve geography portion .? .pls give me solution or idea’s . once again thanking you sir ………..

Please refer our easy-to-learn geography notes.

Today I have my Economy class in my schedule the Same concept was explained by our faculty…but I little bit confused about how the exports of country increases when same country currency value depreciated…but after Reading this entire article I am very cleared about the concepts….thank you

pls comment on this

for exporters ,only sell will increase ,but money they will get will reman same as before,

because in case of devaluation from 50 to 100rs in example. he will have to sell 2 apples for 100rs , in first case also he was selling 1apple for 50rs. so volume wise he will do more export

In respect to his local invironment he is making more money and that is all matters if he spending all money in local. And in respect to international invironment he is making same money.

@ ritesh..

wat u r saying is right, when rupee devaluates exports become costly to us nd our products will be cheaper to the other country, hence they anticipate more goods for the same price, consumption increases and our exports increases, but this will not be helpful for much more import dependant country like india coz inorder to export more we should have good amount of production and raw materials but we dont have, wat we actually do is, import diamonds, rough jewellery and export them polished, import crude oil export refined oil that means the things we are borrowing are much much costly for common man in india. main theme is we can export for some time for appreciation of our currency, but since the cost of imports is more, multi party based country(india) people cant bear for such a long time because it require very very long time to recover our trade deficits and turn into a export based market.so it will be beneficial for a country like china to devaluate its currency to some extent to boost exports as it imports less goods.

I found this article very good ,it’s simply explained and interesting

Thank you for the feedback.

Micro or Macro ‘ fix focus point of discussion.

Why a import based economy like India and Pakistan would depreciate rupee?

What are consequences and reasons to depreciate local currency?

Please answer considering present conditions of both countries.

Good query. For import based countries, depreciating rupee affects the balance of payments, though it may help a few export-oriented sectors like IT. However, no country wishes to be import-dependent and the focus would be to promote export.

Pls clear with an example sir..how is rupee appreciation stimulating the exports? They will get less amount compared to the rupee devaluation..and how does it affect import as we have to pay only less than compared before

For example, consider that Mr.X is an exporter. And consider that he gets 1$ as profit for every batch of export products. If 1$=Rs.45, he will get only Rs.45 in Indian currency/batch. However, if the rupee depreciates and if 1$=Rs.70, then he will get Rs.70 Indian currency/batch. Thus he earns more in Indian currency if the rupee depreciates.

I we the Indians sell those two apples at a cost of 50 rs per each we will get 100 rupees even in india then why to sell to america

Really Vry nice explaination and it’s easy to understand ABT falling of currency in India…thank u sir

Thank you for the feedback.

Sir, really very very very very good explaination. I could see interest that make the students understand concept with simple language, thank you so much

In Devaluation,exporters get quantity demand only because price is cheaper than other countries.

Crystal clear. Thank you:)

if there is devaluation of rupee

will there b more currency to b printed

it will not increase the prices of commodity

thank you sir , it really helped in developing a better understanding on the topic. you explained it in a very simple and very clear cut manner. thank you once again.

i am having one concern, if depreciation takes place does it cause any increase in price of goods. if impacts,how?

You are contributing a significant development in shaping our general knowledge skills…Thanks a lot sir

The best place for upsc preparations. Facts are very lucid to understand.

.

Thankyou so much sir….

Very Nice…Totally Understood the concept why we become less competitive at international market when there is appreciation in indian rupee..

Thank you so much…

Really very helpful and explained in a very simple way. Thanku

Thank you it was really helpful 🙂

Why does this apple example seem flawed?the cost of apple too is decided by the market in the other country.only benefit i can find is that by selling one apple for one dollar we wiĺ get 100 rs after devaluation instead of 50

Thank you for this explanation. solved my doubts 🙂

very very easily described 😊

Thanks a lot sir🙋♀️

Awesome post!

Sir can’t it be in hindi also?

Sir how selling and buying of dollars affects devaluation or revaluation. Please explain with an example

selling and buying of dollars affects devaluation or revaluation in what ratio and proportion. Please explain with an example

The printer friendly version isn’t working

this was really well explained! thanks!

What effect on foreign currency reserve ,when rupee appreciated/depreciated?

Really resourceful content . Grately helped me in understanding core concepts . The examples given at every instance can make even a novice clear about every aspects of the content .

thank you sir !!!! it was really very helpful

Thank you so much sir

It was really helpful

And easy to understand 🙂

Sir , Your article is so helpful for me as I have a doubt, what will happen to the export prices in local currency if the currency devaluated???

Sir,

If I am giving a quotation to a foreign buyer in USD, with what value of USD to INR should I calculate the pricing for the quotation?

Ex: Value of my Goods in INR is 10,00,000 and USD to INR value today is 73.40 (as per Google). so the value in USD is to be calculated @ 10,00,000/ 73.40 = USD 13,623.97

How should I secure myself id USD to INR becomes 73.15.

Will it be a loss for me of 25 paise per USD?

Or Should I take USD to INR at a different rate than actual & Why?

Thanks in Advance.

very helpful this article!

You are best I got it so easily 🤩

Thank you so much 😇

Sir, firstly thankyou for the crystal clear explanation. I also want to know how foreign investments are affected due to this currency appreciation and depreciation? Please explain

Thank You Sir

Sir you explained it in every simple terms.

This is the simplest way of explanation. I’m loving it. Thank you clearias

Thanks a lot, you have explained well